Market Awareness for Engineers: How to Find Funded Work

A practical field guide to durable demand (not hype)

TL;DR

The easy-hire era is over. Track a few signals—earnings tone, open roles, rates/credit, and capex vs buybacks—to find funded teams and have a great career.

Stop chasing hype—chase budget.

Read earnings and rates to find funded, durable work; In tight markets take cash, in easy markets take equity.

One of the most important skills many software engineers lack is market awareness. For the past 25 years, the demand for tech talent was so strong it often masked basic supply–demand dynamics. We all saw it: two-week JavaScript bootcamps producing developers who walked straight into well-paid jobs.

That environment created a generation who rarely had to think about how market forces shaped their careers. But things are changing. The tech sector is moving closer to equilibrium between demand and supply.

So what does that mean for us? Which concepts matter now, and what data should we track to make smarter career decisions?

Understanding the Tech Labour Market (Covid, a perfect use case)

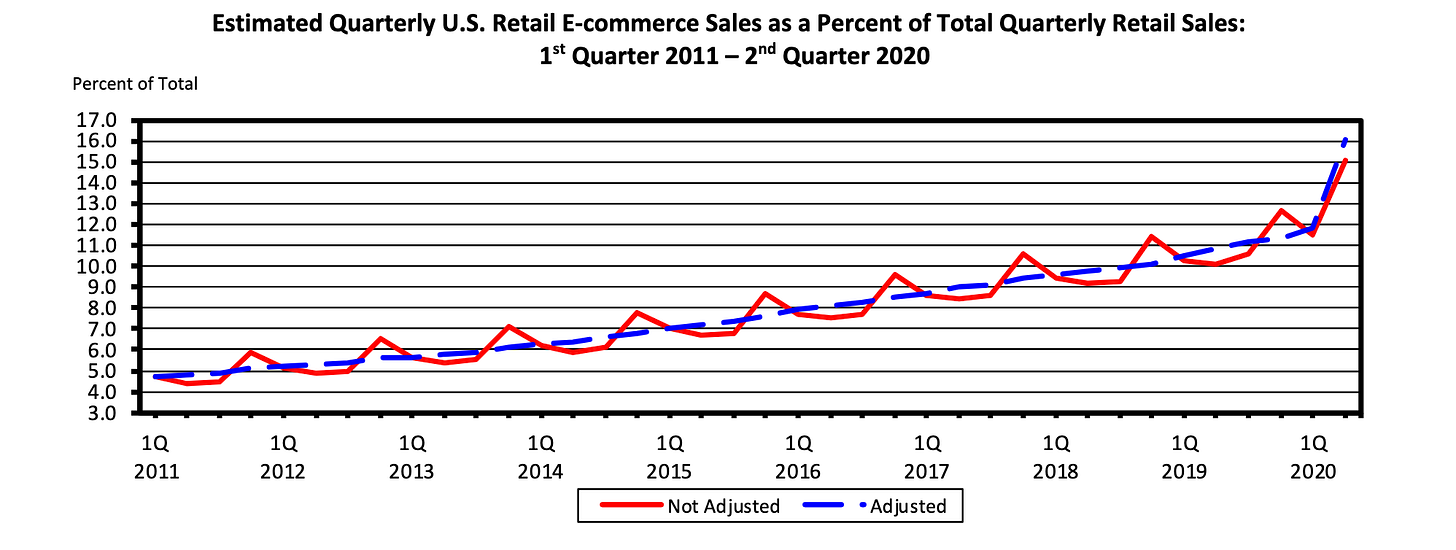

When lockdowns hit in 2020, online demand spiked and many tech companies hired at breakneck speed. U.S. Census data shows e-commerce sales jumped 43% in 2020 (≈+$244B vs. 2019). In Q2-2020, e-commerce briefly reached ~16% of U.S. retail—a clear step-change from the prior trend.

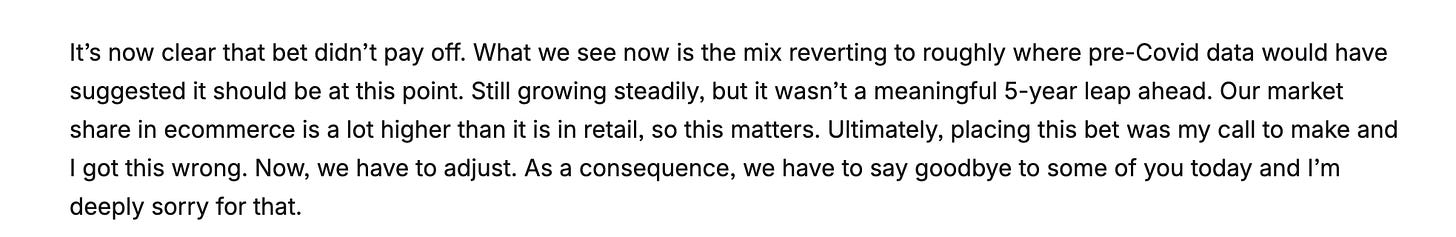

Leaders assumed that surge would stick. In Shopify’s 2022 letter, the CEO wrote that they bet e-commerce had leapt 5–10 years ahead—and got it wrong. Hiring and spend were built for a world that never fully materialised, and layoffs followed.

You see the same pattern in Big Tech. Amazon expanded headcount from ~1.30M (YE-2020) to 1.61M (YE-2021), then announced large corporate reductions through 2022–2023.

Crucially, the macro re-balanced: by 2025, e-commerce’s share of retail only returned to its 2020 peak (~16.3%). The “permanent step-change” thesis reverted—which is exactly why jumping roles purely for a salary spike in 2021–2022 carried hidden risk. If your comp was tied to bubble-era demand, a reversion (plus rising rates) meant freezes, lower equity value, or a reorg soon after you joined.

So what? Treat demand spikes as experiments, not permanent baselines; don’t anchor career bets on step-changes until trend data confirms them.

“Why did smart leaders over-hire? Incentives. Before we look at signals to track, it’s worth seeing how compensation and capital shape the story you hear.”

Think in incentives: why rosy narratives made sense for the C-suite (but not for you)

CEOs aren’t necessarily being cynical—their incentives push growth-first stories:

Equity-heavy pay. Most compensation is stock (RSUs/options). If pay tracks share price/TSR, leaders emphasise “grow the pie” narratives: bigger TAM, faster expansion, “efficiency later.”

Scorecards that reward growth. Proxies (DEF 14A) set targets like revenue CAGR, FCF, and relative TSR—hit the numbers, get paid. Messaging and hiring plans follow those targets.

Cheap-money era logic. In 2020–2021, near-zero rates made future profits more valuable; markets rewarded “grow now, profit later.” When rates rose, the story—and hiring—flipped.

Buybacks & EPS optics. Boards often approve repurchases, supporting EPS/TSR and reinforcing short-term share-price focus.

This is classic agency economics. Incentives shape both decisions and the stories leaders tell.

It wasn’t hard to predict e-commerce would normalize —so why didn’t hiring plans?

Because incentives + narratives lag reality. When e-commerce penetration snapped back toward trend rather than holding a permanent step-up, leaders had to unwind the problem footprints.

So what? You need your own point of view—don’t outsource your read of the market to corporate narratives.

Here’s how to read the real-time signals that cut through the narrative.

What we could have checked in real time (and should check now)

Earnings-call language vs. hiring behavior

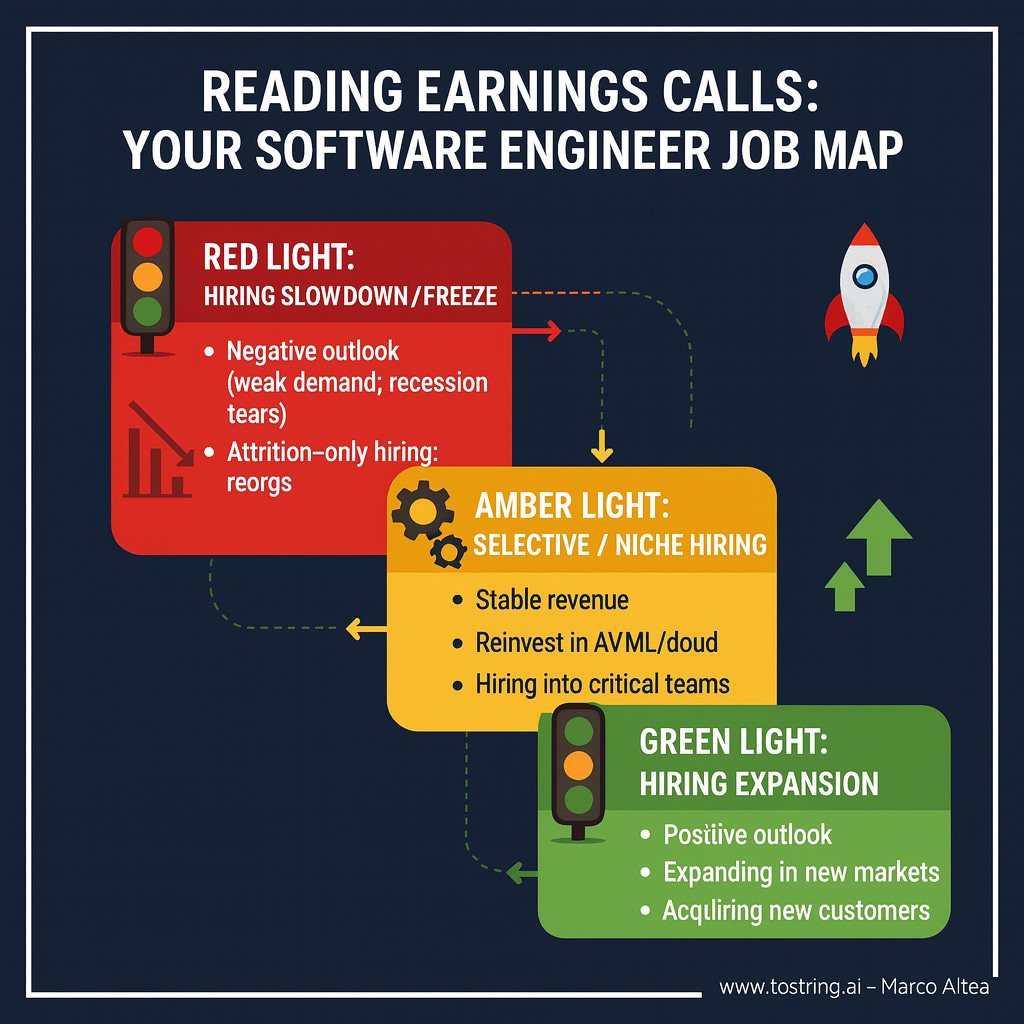

Treat earnings calls like weather reports for headcount.

Red (hiring cools / attrition-only): “Year of efficiency,” “operating discipline,” “rightsizing,” “hiring pause,” “prioritising backfills”; vendors saying “cloud cost optimisation.” Likely outcome: freezes, approvals gated, reorgs.

Amber (selective hiring / mix shift): “Reinvest savings into priority areas,” “balancing growth and profitability,” “hiring into X only.” Likely outcome: pockets of hiring with strict approvals.

Green (net adds resume): “Reaccelerating top-line,” “expanding capacity,” “net headcount growth,” “investing ahead of demand.” Likely outcome: GTM/post-sales first, then platform/infra.

Tell-tale pairings

“Efficiency” + rising restructuring charges ⇒ near-term cuts.

“Profitability focus” + specific functions named (e.g., AI safety, data infra) ⇒ targeted opens—aim there.

“Record FCF” + “capacity investments” ⇒ infra/platform roles tied to capex likely.

Team-level cross-checks

Reqs that keep reposting ⇒ slow approvals / optics.

Many contract-to-hire or 12-month FTCs ⇒ leadership still cautious.

Recruiters say “backfills only” ⇒ neutral to down.

META use case

What they said: In 2023, Meta defined a “Year of Efficiency” on earnings calls—explicitly prioritizing cost discipline and focus.

What happened next: Multiple layoff waves followed in 2023.

How it evolved: By 2024–2025, Meta raised expense and AI capex guidance and signalled selective hiring around AI infra—even as it kept tight controls elsewhere.

When a company’s call shifts to “efficiency,” expect broad hiring to cool—unless leadership simultaneously names protected investment areas (here: AI infra). That’s your green pocket.

Your move as Engineer:

Read the CEO/CFO scripted remarks first; scan Q&A for walk-backs (“we’re not ready to guide to acceleration”).

Track job board counts for 4–6 weeks after the call. If they don’t rise, assume amber/red despite upbeat tone.

Aim at the functions named as investment themes on the call (AI platform, security, data infra, compliance).

Cost of capital & market regime (why rates set hiring plans)

When money is cheap (low rates / easy credit):

Future cash flows are worth more ⇒ growth stories command higher multiples.

Boards reward land-grab/TAM expansion ⇒ headcount grows ahead of revenue; equity comp is plentiful.

Venture/IPO windows open ⇒ startups hire; big tech defends share.

When money tightens (higher rates / wider spreads):

Multiples compress; boards pivot to FCF, margins, durability.

CFOs talk “profitable growth,” “opex discipline,” “unit economics” ⇒ fewer long-duration bets, slower hiring.

Equity becomes expensive currency ⇒ fewer equity-funded growth hires; more automation over manual work.

Practical indicators (no finance degree needed)

Policy rates & 10-year yields: sustained downtrend → thaw; sustained uptrend → freezes.

IG/HY credit spreads: wider = tighter credit = slower approvals.

KPI emphasis: shift from “revenue growth” to “non-GAAP OM / FCF” → leaner orgs.

Comp narrative: “SBC down as % of revenue” / “lower dilution” → slower equity-funded hiring.

Capital allocation: buybacks/dividends while revenue flat → returns over expansion → headcount flat/down.

Stripe use case:

The regime turn: In Nov 2022, Stripe cut 14% of staff. In the CEO memo, Patrick Collison directly cited higher interest rates, reduced investment budgets, and sparser startup funding—a textbook risk-off regime. Letter to employee

Why this matters for you: In tight regimes, boards prize cash flow and efficiency; hiring slows and equity-heavy offers are less attractive (multiples compressed). Stripe’s memo literally frames the pivot from “pandemic surge” to “building for leaner times.”

Rule-of-thumb playbook

Map the regime: are yields/spreads trending down (risk-on) or up (risk-off)?

Match the function: tight regime → cost savers (infra efficiency, security, governance, payments risk, compliance); easy regime → new product / growth GTM re-opens.

Scan language: “Efficiency/FCF” focus? Expect calibrated hiring; target named growth vectors.

Negotiate comp accordingly: tight regime → push for higher base + sign-on, discount equity headlines.

Put together: incentives explain the story, signals show the turn, and the rate regime sets the speed limit.

You are thinking to do a move and you have an offer on your hands? use the checklist below to asses the company status

Checklist to company review

Open last earnings call: highlight “efficiency / invest ahead of demand.”

Count open reqs for 3–4 weeks post-call (flat/down = red/amber).

Skim proxy/annual report: what are CEO LTIP metrics (TSR, FCF, revenue)?

Note regime: are 10-year yields/spreads trending up or down?

Decide: cost-saver pockets vs growth pockets

Conclusion: the easy-hire era is over

The days when tech demand vastly outstripped supply—when two-week bootcamps placed grads into high-paid roles and a diploma alone could secure an offer—are largely gone. The market is closer to equilibrium now. A CS degree is still valuable, but the paper won’t get you hired by itself; demonstrable skill will and CS course could give you that, remember Algorithms and Data Structure?

Study computer science because you like the craft, not for “easy money.” Pair strong fundamentals with market awareness—read earnings signals, understand incentives, and aim your work at problems tied to revenue, cost, or risk. Do that, and you won’t need a bubble to build a great career.

Special mention to two newsletters that help my market awareness

- has a Pulse edition on the state of the Tech market and

- always provide an updated view on the tech recruiting market and advise on what metrics you should keep track

If this helped, subscribe to toString.ai for practical, no-hype playbooks on building and career moves—one great read a week.